Allocator’s Notebook: Ribbit Capital Funds I-III, 2012-2017

Sometimes, exceptions pay more than the rule

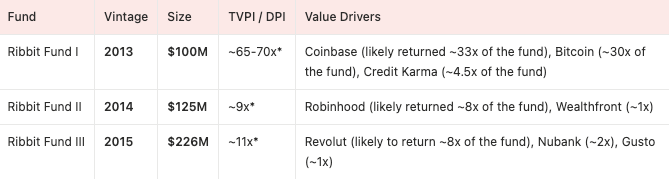

We now continue with the second piece of the series, focusing on Ribbit Capital’s first few funds. Ribbit was a tricky one without publicly available returns data and flying under the radar for the most part. Still, even without precision, studying potentially the best-performing venture fund of all time reveals a clear enough picture.

While I tried to range-bound the performance of Ribbit’s funds, most numbers aren’t precise, and I welcome any updates and corrections you might have. Here’s the first USV piece for those who missed it.

Setting the Stage

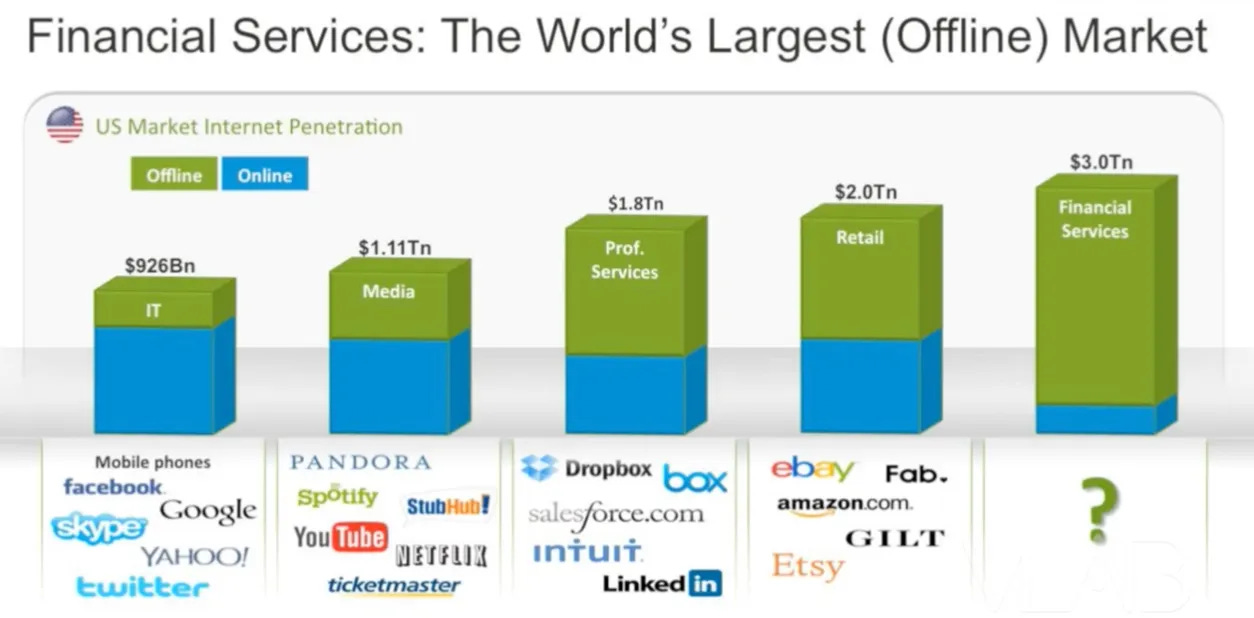

Micky Malka founded Ribbit Capital as a solo GP in 2012 to invest in technology companies building the last mile in financial services. The investment team for Fund I included Nick Shalek, who was part of the founding team, and Nikolay Kostov, who joined them in 2013. The three partners constituted the core investment team for the first three funds. By the time they started, fintech wasn’t a real category.

Micky was born in Venezuela and founded his first company, Heptagon Group, a broker-dealer, at the age of 17. Before Ribbit, he didn’t have investing experience—he was a serial entrepreneur who built and exited a total of five companies within financial services, most of which were with Wances Cesares, and the biggest of which was Patagon, acquired by Banco Santander for $750M in 2000.

Nick started his career at Yale Investments as an LP and then spent a few years at General Catalyst, one of their fund investments at Yale, to focus on incubations. He then joined Micky while he was at Stanford GSB. Nikolay joined them from Morgan Stanley, where he was a tech investment banker.

Ribbit’s Fund I had BBVA and Silicon Valley Bank as institutional investors, rest mostly being high-net-worth individuals. Fund II onwards, their LP base becomes more institutionalized and includes the likes of Emory University Endowment, MIT Pension Fund, The Employees’ Retirement Plan at Duke University, Carl Victor Page Memorial Foundation, Sequoia Heritage, and Iconiq Capital.

Key Investments

Bitcoin: Ribbit Fund I accumulated a large direct BTC position in early 2013.

Tracking public clues, my estimate is they built a ~$5M position around Feb 2013, owning 2-2.5% of the entire BTC supply at a ~$20 price while the BTC market cap was around $220-225 million.

Bitcoin was their first investment in crypto before finding any viable teams to back. At the time, they had the biggest BTC position of any venture fund, also capitalizing on their flexible fund structure that allowed them to directly invest in it, unlike most venture capital funds.

Averaging out on the way up to the 2017 peak at $5k, $10k, $15k, $20k would generate a ~625x multiple and return ~31× of $100M Fund I. Exiting the entire position at the 2017 peak would generate a ~1,000x multiple and return ~50x of $100M Fund I.

Coinbase: Ribbit Fund I joined the $5M Series A round (2013) led by USV.

Brian Armstrong (30*) was an Airbnb engineer, and Fred Ehrsam (25*) was a Goldman trader prior.

Micky says that their exposure to the crypto ecosystem with their Bitcoin investment had exposed them to broader problems around it, like storage, fiat on- and off-ramp, etc., and they naturally recognized the potential in companies like Coinbase.

Coinbase went public in April 2021, at $85B. Ribbit Fund I reportedly held around 4% which was worth around $3.3B, ~33x of $100M Fund I.

*Age at the time of the Ribbit investment

Robinhood: Ribbit Fund II joined the $13M Series A round (2014) led by Index Ventures.

Vlad Tenev (27*) and Baiju Bhatt (30*) were Stanford math-physics grads who had previously founded Chronos Research, which provided high-frequency trading infrastructure for hedge funds.

Micky had built an online brokerage himself, Patagon, in 1998. He was attuned to the opportunity and knew what it took to succeed. He notes that the founder team were the customers themselves as part of the same generation, they had a good understanding of the infrastructural complexity as math-physics grads, and had great taste in design.

Robinhood went public in July 2021 at $32B. Ribbit Fund II reportedly held around 3% which was worth around $1B, ~8x of $125M Fund II.

*Age at the time of the Ribbit investment

Revolut: Ribbit Fund III invested $2.8M in the Series A round (2016) led by Balderton at a $55.6M valuation.

Nik Storonvsky (31*) was an equity-derivatives trader at Lehman Brothers and then Credit Suisse before starting Revolut.

Micky says they looked at many players around the world to benchmark globally and picked Revolut to back as the international neobank, highlighting Revolut’s customer obsession.

In light of Revolut’s $75B secondary valuation in 2025, this would imply a ~$1.8B stake just based on their initial check, ~8x of $226M Fund III.

*Age at the time of the Ribbit investment

Nubank: Ribbit Fund III joined the $80M Series D round (2016) led by DST Global.

David Velez (35*) was an investor at Sequoia Capital prior.

At the time, Ribbit was vocal about fintech being a global opportunity and fintech businesses not always traveling across borders, enabling one to build big companies within any major region. They note that Brazil was an oligopolistic market in banking that didn’t serve the customers well and didn’t pass through savings to them—creating the right conditions for a mobile challenger.

Nubank went public in December 2021 at $41.5B. Ribbit’s ownership was below 5% at the IPO and not explicitly listed, though we can estimate a $15-20m check to get them 2-2.5% of the company at the time (valuation known to be $500M-1B) with a likely ownership of +1-1.5% around the IPO which was worth around $400-500M, roughly 2x of $226M Fund III.

*Age at the time of the Ribbit investment

Learnings

As in the USV story, it is never too late to build what could potentially be the best fund in venture history. Micky was 38 years old when he founded Ribbit, having built five companies prior, most with good but none with generational success.

Failures can seed success. Bling Nation, Micky’s latest company before Ribbit, didn’t work out and eventually was a minor exit of $43M following Micky’s leave. Micky says this was the first time he had failed in life.

LPs hesitant to back an outsider solo GP without a track record would pass on Ribbit’s ~70x Fund I. Micky was a solo GP who moved to the Bay Area in 2007, not from central casting, and without insider dealflow or access. In terms of track record, Micky says that he had no investment track record, and their first deck had more Star Wars analogies than anything.

Unequal partnerships work with enough trust. Ribbit didn’t start as an equal partnership; Micky was a 38-year-old GP backed by two junior partners who were 10 years younger. Micky believed in getting the right talent young and training them internally. He says, “I start people with 100% trust, not 0% to let them build. When he started, Nick wrote a $1M check to a company I was never convinced of. You let them do, we could afford that bet. We got a 95-cent check from that company and hung it to remind us of this principle.”

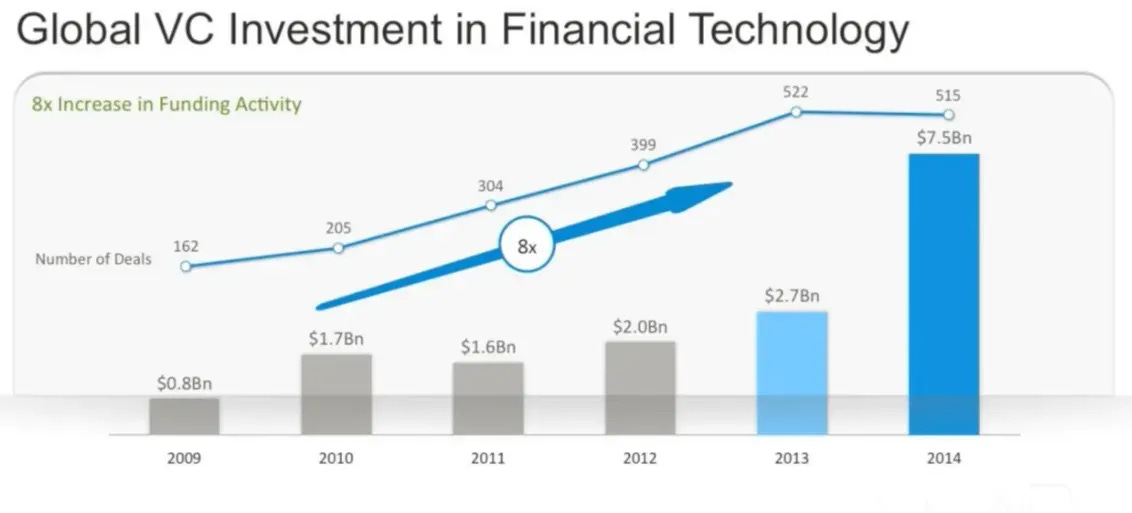

They raised the fund to bet on a well-defined thesis. The thesis was to find the companies building the last mile in financial services all around the world to touch customers. They bet on the combination of the right macro timing, as banks lost trust and faced regulatory scrutiny post-2008 crisis, the emergence of mobile as a new channel, and the availability of unstructured data. During Ribbit’s first few funds, total capital moving into fintech, an overlooked category in the late 2000s, grew 2x quicker than the rest of the venture.

From Nick Shalek’s SV Takes On Wall Street Talk in 2015 They were global from the beginning. They were vocal about seeing the opportunity in fintech as a global one, as fintech businesses do not always travel across borders, and one could build big companies in lending, wealth management, or insurance within any major geography. They discussed the potential for companies in China or India to leapfrog the US counterparts, figuring out the mobile channel and software faster, with existing learnings from the US to acquire 100s of millions of customers much faster. This led to massive wins like Nubank and Revolut.

Their biases made them special. Growing up in Venezuela, Micky had experienced every single macro event before he was 15 years old—be it hyperinflation, devaluation, capital control, or banking system collapse. He ran a financial services company in Venezuela when the banking system collapsed, and he was there during Argentina’s economic turbulences. With such macro lessons, Bitcoin was just obvious.

Flexibility of their mandate enabled them to capitalize on opportunities others couldn’t. In 2012, they were the only fund whose documents allowed them to own crypto directly. Micky says that they didn’t like labels, and theirs wasn’t a venture firm; that’s why it was called Ribbit Capital. They didn’t know if they would be early, late, or invest in public markets—and they structured the fund accordingly. While their BTC position has returned ~30x of the fund, it also paved the way for other value drivers like Coinbase and Pantera Capital (further flexibility investing in a fund), leading to a ~70x fund eventually.

The best funds are built in fringes. In a 2013 panel with Nick Shalek, his fellow panelists Stefan Glaenzer and Michael Jackson note that the Bitcoin industry is currently only worth around $1.6 billion, it’s not really on the radar of many investors, and from a venture point of view, Bitcoin is not significant enough—hence why interest in it is low. Michael Jackson says, “Endowments and pension funds giving money to us, we need to be fairly certain they come into a secure and legally viable framework. I have to be able to present a credible case to these guys, and they feel like I haven’t completely lost my mind when I invest in a Bitcoin exchange and it goes wrong.” Ribbit’s Bitcoin and Coinbase investments, a few months before this panel, eventually returned their $100M Fund I ~63 times.

In fringes, founders don’t knock on the doors of VCs. In the same 2013 panel, Nick’s fellow panelist Glaenzer says, “We saw 1,987 business plans last year, and there was not a single one on Bitcoin. I assume many of the Bitcoin entrepreneurs are still bootstrapping. Also, I was an entrepreneur and now a VC for two years; you tend to become lazy as a VC and wait until someone approaches you.” While Jackson says, “I haven’t seen anything that is interesting because it hasn’t come in the inbox to the certain extent.” Nick responds, “We saw a lot of Bitcoin companies, maybe we made ourselves too available, some we sought out and some came to us.” Micky also spoke about this, saying he had more luck than failure, but had worn more shoes and spent a lot of time out there than most people.

Sometimes, exceptions pay more than the rule. In the 2013 panel with Shalek, Stefan Glaenzer says, “As a fund, we are not set up in buying Bitcoins, we’re not buying public stock whatsoever.” In a 2014 panel with Micky Malka, Hemant Taneja of General Catalyst says, “We wouldn’t invest in Bitcoin. If our LPs want to hold currency, they should go buy currency themselves.” Whereas Micky says, “It is very easy, we wrote a 19-page letter to our LPs (available here) on why we got the conviction and we got the approval.”

They had their share of misses. Nick points out digital payments as their biggest miss as a category, which included the likes of Stripe, Adyen, Stone, of which Ribbit passed on. He says, “We had a view that digital payments were commoditizing and it would be a declining margin business—kind of thing an expert would say and sound smart. But it was naive and reflected a static view of the world; it just had too much certainty. You have this intellectual view, but when you look at what developers and merchants are doing, you have to realize you are fooling yourself at some point.”

Ribbit’s favorite question for founders was “Who is your customer?”. They had a clear focus on founders building the last mile in financial services and were aware that, in financial services, unlike most other categories, there were dozens of customer niches where one could build massive companies. This specialist view filtered into their perspective on picking founders.

Ribbit wasn’t the lead investor in any of their biggest value drivers. They didn’t lead any of the initial rounds above for Coinbase, Robinhood, Nubank, Revolut, but still wrote meaningful checks and had exceptional returns.

Power law dominates hit rate even at later stages. One of the defining statistical rules of the power law is that hitting a tail outcome (say, a 10x fund) is more likely to happen with a single 10x deviation than the combination of multiple smaller deviations. For outlier funds, even in later stages or with a higher hit rate, the mathematics doesn’t seem to change. It’s all about the upside of one’s winners rather than how many winners one would have.

There’s no harm in deploying fast if you face the right opportunity window. Their deployment was much faster than the average timelines, deploying three funds in four years, all achieving outlier returns.

Resources

Here are some of the resources I have used while getting this piece together. If you’ll browse a single one from the list, click number 2 to watch the video of a panel which Pamir Gelenbe, then at Hummingbird, hosted in July 2013.

great piece, thank you for putting this together

This series of fund-performance breakdowns is so insightful. Thank you!